Everyday banking made easy

BRED Bank Cambodia has set the standard for personal banking in the Kingdom. With a full suite of banking products, market-leading interest rates, an extensive branch network, unparalleled service, international safety and security standards and exceptional digital banking, BRED truly offers the smarter way to bank.

Account packages

From our entry-level Silver package to our premier banking Platinum package, BRED Bank offers all the flexibility you need from your bank. Each package comes with USD and KHR current accounts as well as a linked savings account. You’ll have access to a dedicated Relationship Manager and our call centre is open 24 hours a day for help and guidance. So, take a look at our account packages and pick the one that suits you best.

Learn MoreSavings

With BRED Bank there are lots of ways to earn interest on your money. From instant access savings accounts to long-term fixed returns, we’ve got everything you need to get more for your money – and we always pay our best rates when you save in KHR!

Learn More

Loans

We offer some of the most competitive home loan rates in the Kingdom and we’re here to help you secure your dream home. We also provide affordable loans on everything from new cars to home improvements to holidays and luxury purchases.

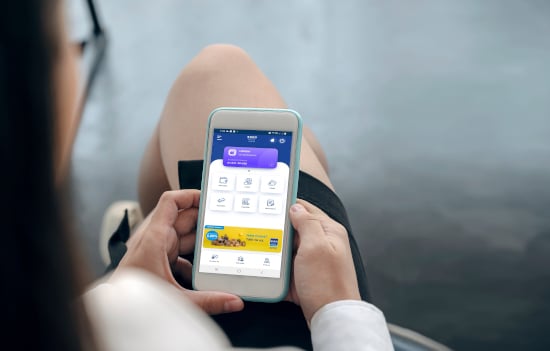

Learn MoreDigital banking

Everyday banking is easy with BRED Bank. Just log in to our online banking portal or use the BRED Connect app to pay bills, move funds, check balances and much more.

Learn More